UK M&A Review 2020

As a leading player in process support of transactions and due diligence, the use of our Data Rooms says quite a lot about what is moving in the market and how the processes take place. We observed how the pandemic caused uncertainty in the M&A market for the first few months of 2020, but is on the mend of recovery now.

Article by Berna Albay, UK Head of VDR, Admincontrol

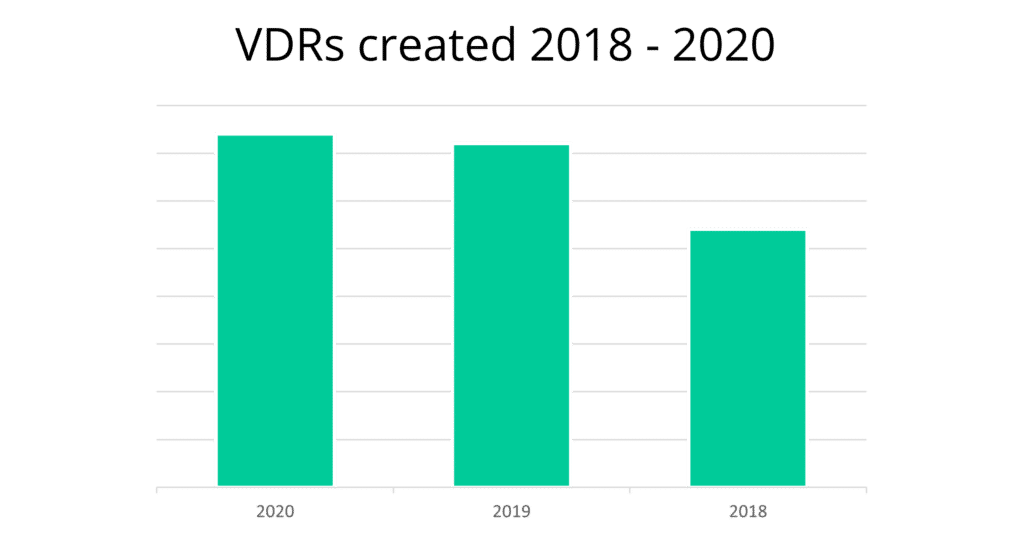

2020 was a strong year for Admincontrol, and we saw an increase in total sales for Virtual Data Rooms compared to 2019, mainly in the following sectors: Technology, Business Services, Renewable Energy, and Healthcare.

However, in Q2 Admincontrol recorded a decline in new transaction, and some transactions were put on hold. Fortunately, this was short lived, and activity picked up again quickly.

Covid forced more virtual due diligence

An interesting observation is that the Covid situation have forced more virtual due diligence, due to the restrictions of face-to-face meetings and travelling.

The digital platforms have been given more space in everyday life and we will certainly continue to see an increased interest in digital DD processes as an effect of the pandemic.

Sindre Talleraas Holen, M&A Director at Visma, and his team completed several digital due diligence processes in 2020 – without any physical meetings with the other party.

And Holen thinks this will be the ‘new normal’ also after the pandemic.

He says:

– Covid-19 has been a “game-changer” and it has pushed forward the digitalization of the M&A market.

He continues:

– Starting a Due Diligence in a Data Room without physical meetings is not as strange as it was in March 2020. We are getting used to this new situation.

In 2021, we therfore foresee that more virtual due diligence will occur, which could increase our sales compared to 2020. We remain confident that thanks to the skills and resources of Admincontrol, the outstanding performance will continue.

What is expected for M&A in 2021?

We see several factors that are likely to affect the market the coming year, such as:

- Private equity dry powder

- Government-backed Future Fund

- Brexit

The UK private equity sector played a growing part in the M&A market last year with substantial reserve capital and we are confident this sector will remain very active in 2021. Also, with the Government-backed Future Fund set up in the UK, we predict a further growth for tech and life science investments.

Impact of Brexit on the UK M&A Industry

Now that Brexit has been actioned this may have a significant positive impact on UK M&A sector, as the uncertainty that was there previous to Brexit action has now been removed.

However, there will be legal effects of Brexit, and legal due diligence in M&A transactions should focus specifically on contract law, as there will be changes in the law because of departure from EU. The critical aspects of legal due diligence may vary, but some areas to look out for would be supply and distribution chains, Data Protection, IP, employee’s contracts.

Best of luck for the new year!